By Larry Domash - the tables in this report are generated from a systematic credit trading model that covers over 6000 bonds. Outputs are available by issuer curve, sector and LQD portfolio. The outputs can be used to inform trading and risk management teams. If you are interested to learn more, please contact gareth.moody@empirasign.com. Thank you

As we begin the week of July 14, 2025, equity prices are showing hesitation across multiple sectors. The upcoming release of June 2025 Consumer Price Index (CPI) data on Tuesday, July 15, alongside the start of bank earnings season on the same day, is expected to influence market dynamics. Following last week's discussion on trade tariffs, we will focus on other factors. Market reactions to news headlines are likely to drive risk prices over the next 24 to 48 hours. Our systematic credit trading model is designed to respond to these market movements rather than predict them.

Weekly LQD update and Systematic Credit Trading indicators

.

Avoid long = de-levering issuers where underlying equity price is (-10%) over the past 30 calendar days

The weekly update for the LQD (iShares iBoxx $ Investment Grade Corporate Bond ETF) and systematic credit trading indicators provides insight into current positioning. As of Friday, July 11, 2025, our systematic trading model includes 2,206 of the 2,918 bonds held in the LQD. Among the 184 issuers covered, 52% of the bonds in the LQD were issued by companies re-levering their balance sheets, while LQD positions were nearly evenly split, with approximately 50% from de-levering issuers.

Week-over-week changes include a modest reduction in U.S. financial holdings from re-levering issuers, while non-U.S. financial holdings from de-levering issuers remained stable. There were additions to BBB-rated Technology, Media, and Telecom (TMT) bonds, though the model did not participate in the recent NTT bond issuance. Additionally, holdings in re-levering consumer and industrial issuers saw a slight decrease.

We have read several trading ideas suggest shorting or going long on individual bonds against LQD holdings. From a stochastic quantitative perspective, analysis of Q2 2025 shows that credit trading alpha was more effectively generated by holding attractive long positions in de-levering sectors, specifically Yankee Banks and Yankee TMT, while also maintaining exposure to the LQD.

The LQD, with its long-only mandate, is a well-constructed investment-grade portfolio designed to minimize both credit and interest rate risk, resulting in lower volatility. Consequently, the majority of alpha-generating trades relative to the LQD involve going long on underweight attractive sectors while also holding the LQD. Such trades have a 72% probability of outperforming the investment-grade index over a 44-trading-day period.

Upcoming Earnings

This week, 29 major US corporate debt issuers will report, 25 of which are among the 255 largest global corporate borrowers. Of these, 21 are financial issuers, and 14 of the 25 G-255 issuers were reducing net balance sheet debt as of Q1 2025.

Key Issuers reporting results Tuesday

Blackrock Inc (BLK, Aa3/AA- Not a G - 255 issuer) Bef-mkt Q2 25

Albertsons Cos Inc (ACI, Ba3/BB+ Not a G - 255 issuer) Bef-mkt Q1 26

JPMorgan Chase & Co (JPM, A1/A attractive short) 06:45 Q2 25

Bank of New York Mellon Corp/T(BK, Aa3/A attractive long) Bef-mkt Q2 25

Wells Fargo & Co (WFC, A1/BBB+ attractive short) 07:00 Q2 25

State Street Corp (STT, Aa3/A attractive long) 07:30 Q2 25

Citigroup Inc (C, A3/BBB+ attractive long) 08:00 Q2 25

Inflation, Economic Data, and Interest Rates

US CPI Data Release: The June 2025 Consumer Price Index (CPI) data is scheduled for release on Tuesday, July 15, 2025.

Core CPI Trend: CPI excluding food and energy has decreased by 0.5% since January 2025, reaching 2.8%.

Forecast: Estimates suggest a slight increase in core CPI for the June report.

Federal Reserve Context: Two additional CPI readings are expected before the Federal Reserve's September 2025 meeting.

YTD 10Y UST yields are (-16bp) lower while most of the rest of the world 10Y rates are higher.

Systematic Trading Model Insights and Trading Strategy (July 14, 2025)

The Systematic Trading Model analyzes data for over 6,000 bonds, with 658 currently within 20% of their 52-week tight or wide spread levels (17.6% above historical averages). Over the past week, there has been a significant reduction in bonds trading near 52-week tight spreads in sectors identified as overvalued by the model.

Current Trading Allocation Strategy

-57% long

-23% short

-20% front-end allocation (75% in floating-rate notes maturing within 3 years, targeting undervalued, de-levering bonds).

Performance: Of 131 long/short trades (marked to market via TRACE) in 2025, 90% achieved ±5 bp targets, averaging ±7.56 bp per trade.

Recent Activity:

-The model paused adding short positions on July 2, 2025, due to the number of non – replaced long trading positions over the last week of June – first week of July

-Between June 30 and July 11, 2025, 11 long trade indicators reached “avoid” levels, prompting a shift to a “more short” stance in the long/short basket.

-Thursday’s trading allocation adjustment was driven by recent credit fund outflows.

Sector Trading Recommendations for Monday

Long:

-Yankee Banks (particularly floating-rate notes).

-Single A TMT.

Short:

-U.S. Big 6 Money Center Banks.

-Single A Healthcare.

-Single A and BBB Industrials (re-levering, with tight spreads).

-BBB TMT with larger issuer tech firms re-levering.

Risk Management:

The model avoids adding risk to G-255 issuers scheduled to report results within 30 days, in compliance with global regulatory requirements for reporting “material events” within 30 days of a scheduled earnings release.

Friday’s U.S. Credit Trading

Investment-Grade (IG) Trading

-Volume: -26% below average

-G-255 Issuers: 95 of the top 100 traded issuer bonds, accounting for 97% of top 100 issuer volume and 78% of total TRACE volume.

High-Yield (HY) Trading

-Volume: -9% below average

-G-255 Issuers: 14 of the top 25 traded bonds, accounting for 60% of top 25 issuer volume and 52% of total TRACE volume.

Market Movement

U.S. CDX Index: +1bp wider Friday @ 51 bp

U.S. IG Cash Spreads: Were +1bp to +2bp wider; US financials and consumer staples underperformed while subordinated bonds in general were unchanged

CDX HY Index: fell -.3 pt @ 107.50 (per Bloomberg)

HY Cash Bonds: BB Communication and Financial Bonds were unchanged and outperformed. HY utilities were TMT were lower.

High-Yield Activity

- Dealers sold $ 400 million of HY bonds Friday.

Most Bought HY Bonds by End Users

- Macy’s Retail Holdings (M Ba2/BB+)

- CSC Holdings (CSCHLD, Caal/CCC+ attractive long)

Most Sold HY Bonds by End Users

- Nissan Motor Corp (NSANY Ba2/BB attractive long)

Investment-Grade Activity

- Dealers net sold $2.400 billion of IG bonds Friday.

Most Sold End User Sectors and Bonds

- Single A TMT – was the most sold IG sector Friday.

NTT new issue (NTT, A3/A- attractive short)

Morgan Stanley (MS A1/A- attractive short)

Most Sold Bought Issuer Sector: Big 6 banks and BBB TMT

- Wells Fargo (WFC, A2/BBB+ attractive short) was the most bought Big 6 bank issuer.

- Broadcom (AVGO, Baa1/BBB+) was the most bought BBB TMT issuer

Attractive Trading Sectors

Long Opportunities

Floating Rate Notes of de-levering issuers Overall model indicators 208 bonds ($306 billion) are considered undervalued by the stochastic credit trading model with 79 attractive long trade indicators for the entire 6,000 bond universe.

Short Opportunities

1376 bonds ($1.08 trillion) are considered overvalued by the stochastic credit trading model with 579 attractive short trade indicators for the entire 6,000 bond universe.

U.S. Big 6 Banks (All Ratings): $721 billion in overvalued market capital across 286 bonds, with 90 short recommendations.

BBB TMT $212 billion in overvalued market capital across 128 bonds, with 40 short recommendations.

Single A, BBB and Industrials $144.3 billion in overvalued market capital across 115 bonds, with 56 short recommendations.

Single A Healthcare $175.9 billion in overvalued market capital across 120 bonds, with 47 short recommendations.

Issuer News

Exxon Mobil Corp (XOM, Aa2/AA-, attractive long): Exxon Mobil Corp will borrow crude oil from the Strategic Petroleum Reserve after reducing operations at its Louisiana refinery due to quality issues in crude supplies from the Gulf of Mexico. The issue originates from Mars crude, a grade of oil with elevated zinc levels, a contaminant that can cause corrosion and damage refinery equipment, according to sources familiar with the matter.

Chevron (CVX, Aa2/AA-, attractive short): A Chevron spokesperson stated that the company has identified a potential source contributing to the changes in Mars crude composition, linked to the start-up of a new well, and is working to address the issue.

Kraft Heinz Co (KHC, Baa2/BBB, attractive short): Kraft Heinz Co is preparing to restructure by potentially spinning off a significant portion of its grocery business into a new entity to address shifting consumer sentiment and a declining share price, according to sources familiar with the matter. The company is considering focusing on faster-growing segments, such as sauces. A Kraft Heinz spokesperson noted that the company has been evaluating strategic transactions to enhance shareholder value, as announced in May.

UniCredit SpA (UCGIM, Baa1/BBB+, attractive long): UniCredit SpA is evaluating next steps for its takeover plan of Banco BPM SpA amid uncertainty following an Italian court ruling. The court overturned two conditions imposed by Italy for UniCredit to complete its bid but upheld other requirements that CEO Andrea Orcel previously indicated could derail the takeover plan.

Credit Agricole SA (ACAFP, A3/A-, attractive long): Credit Agricole SA is seeking to increase its stake in Banco BPM SpA above 20%, according to a statement. The French bank, which currently holds 19.8% of Banco BPM after increasing its stake earlier this year, plans to acquire enough shares to push its ownership "just above" 20% but does not intend to acquire or exercise control.

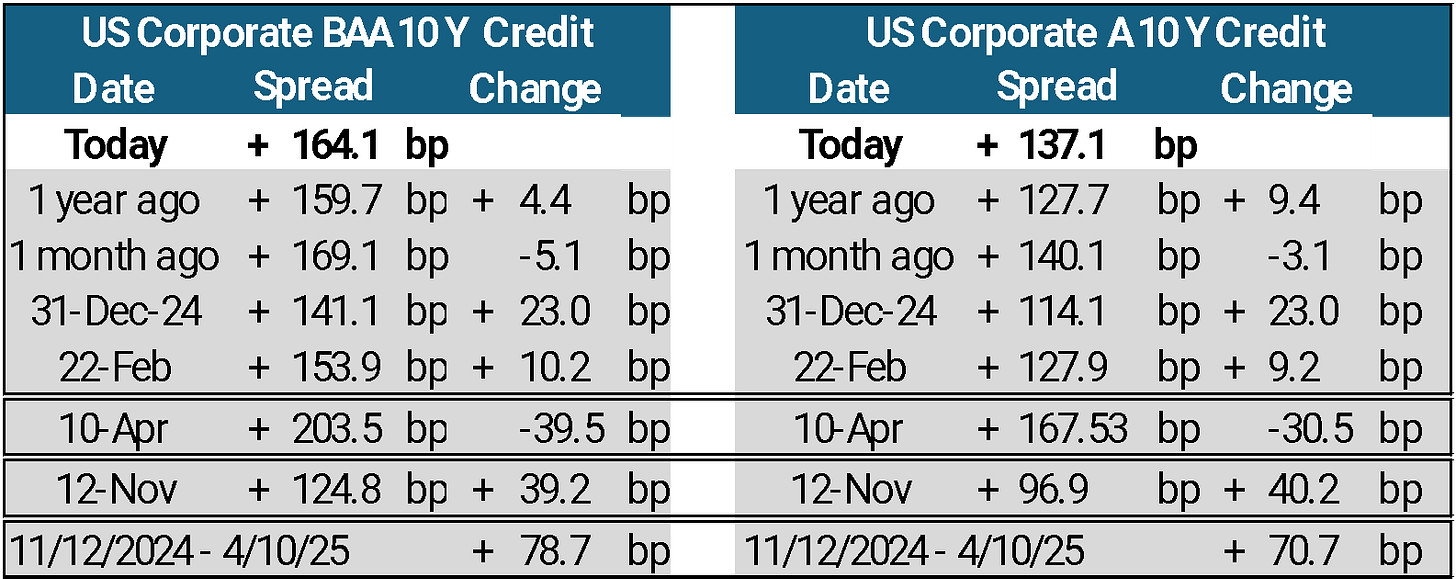

U.S. IG Credit Valuation and Spreads

Spread Recovery: U.S. credit spreads have recovered 45% of the widening observed from November 12, 2024, to April 10, 2025.

Valuation: U.S. credit remains slightly overvalued based on output from our credit trading model.

Global Equity Correlation to IG Credit Spreads

U.S. IG credit spreads and U.S. equity prices showed directional correlation for the 53rd time in 60 trading days as both markets were slightly lower on Friday. With bank earnings reports beginning Tuesday, we will see how both markets react.

New Supply, Bond Maturities, and Credit Fund Inflows for July

Total Supply: USD G-255 supply reached $27 billion in July 2025 as of last week.

Non-financial USD supply accounted for 92% of July G-255 issuance.

Non-financial USD supply represented 48.4% of USD large-cap bonds in 2025.

Market Dynamics: Post-bank earnings reports this week are expected to alter the proportion of non-financial USD supply.

Key Issuances

NTT Deal: $10.5 billion, priced on Wednesday in a seven-part structure.

Systematic Model Indicator: Deemed attractive by the systematic trading model despite the issuer's re-leveraging.

Performance: Outperformed model attractive levels within 24 hours of pricing.

Sector: Single A TMT (Technology, Media, Telecom), the most net-bought sector in 2025.

Nissan $3 billion, issued in 3 tranches.

Context: Issued amid negative auto sector headlines and a 9% decline in Nissan’s 7201 equity price.

Systematic Model Indicator: First high-yield model deal published in 2025, deemed attractive by the systematic trading model.

Performance: Outperformed model attractive levels within 24 hours of pricing.

Sector: USD autos, the second most sold trading sector in 2025.

Fund Flow Trends

Investment-Grade Bond Funds: Recorded inflows for the seventh consecutive week, as observed on Friday.

High-Yield Bond Funds: Experienced outflows during the same period.

Systematic Model Observations

Both NTT and Nissan deals exceeded systematic model attractive levels within 24 hours, indicating strong market reception relative to model expectations.

The TMT sector’s spread tightening reflects sustained investor demand, while the auto sector’s performance highlights resilience despite negative sentiment.

Systematic Trading Model Indicators and Strategy

Model Output

Attractive short recommendations were more or less unchanged after Friday’s close @ 579. That’s – 191 fewer week over week. The majority of the decline stems from sectors flagged as overvalued by the trading model over the past month.

79 attractive long recommendations: 7 fewer than Friday.

Systematic Portfolio Trading Model Recommendation:

Prioritize Long Positions: Focus on deleveraging new issues with attractive valuations. Ideal maturity for long positions is 7 years.

Short Positions: Target re-levering issuers trading at the deepest discount from their model avoid point. Avoid short positions with maturities around 7 years, as they are the least attractive.

Replace Longs: Replace systematic attractive long positions that have reached their avoid trading level.

Portfolio Trading Hurdle: Once the portfolio reaches a 75% long hurdle, maintain a 1:1 long-to-short ratio for additional positions.

Current Status of trading indicators below:

-11 long trades have reached their avoid trading levels and require replacement.

- Nissan new issue long trading recommendation published Friday reached its avoid trading level.

Systematic Credit Trading Strategy July 14, 2025

Closed Positions: Exited the 11 long trades that have reached their avoid trading levels (including the Nissan 5Y from Friday) over the past 2 weeks.

Enter New Longs:

Implement new attractive de-levering supply that comes to market this week per the published recommendations.

Monitor Portfolio Composition:

Track the percentage of long positions relative to the total portfolio.

If replacing the 11 long positions that have reached their avoid trading level pushes the portfolio above the 75% long hurdle, initiate short positions in re-levering issuers (avoiding 7-year maturities) at a 1:1 ratio for any additional long positions.

Review: Reassess portfolio balance after next Thursday’s fund flow data to ensure alignment with the systematic model.

Systematic Credit Long/Short Basket Trade

The trading model uses predefined, back-tested processes driven by issuer data and market parameters, targeting ±5 basis points of spread movement in minimal trading days while minimizing volatility risk. The model employs only publicly available data.

Current Sample Systematic individual bond trades based on trading strategy

Most Recent Systematic long/short trades:

Thursday/Friday the model adds the Nissan (Ba2/BB) NSANY 7 ½ 07/17/30 with (-10bp of projected spread tightening. The bond reached its avoid trading level on Friday.

Systematic Long/Short Basket Trade Performance Report (January 4, 2025 – July 11, 2025)

Total Trades: 131 (1% of total recommendations).

Performance Summary:

Long Recommendations: 91/100 reached avoid-trading levels, tightening by -9.53 bp.

Short Recommendations: 27/31 reached avoid-trading levels, widening by +5.49 bp.

Remaining Longs: 9 tightened by -2.67 bp.

Remaining Shorts: 4 tightened by -10.5 bp.

Average Spread Movement: ±7.56 bp in the recommended direction.

Success Rate: 90% of recommendations reached avoid-trading levels which is normal.

Average trade holding period: (22 trading days) + 17% above normal.

Disclaimer - This report is not intended as, and does not constitute an offer, or a solicitation to buy or sell any securities or financial instruments. All data, levels, opinions, and representations herein are provided for informational purposes only and should not be relied upon for making investment decisions. Past performance is not indicative of future results. The authors of this report assume no liability for losses or damages arising from the use of this information. Investors should consult with a qualified financial advisor before making any investment decisions. The information in this report is based on sources believed to be reliable, but no guarantee is made as to its accuracy, completeness, or timeliness.